In nine easy steps we show you how to simplify your life, become more self-reliant and save some much needed cash.

Even before the Australian bushfires and Covid-19 hit, many of us reported feeling the triple whammy of increased working hours, the rising cost of living and high stress levels.

With seemingly less time for ourselves and our families having to work long hours (even if your job is satisfying and fulfilling) to make ends meet affects your quality of life.

And if you’ve recently had your hours reduced or been stood down, this added pressure can be overwhelming.

With this in mind, we thought we’d put together some easy steps to getting your budget in order, and also show you how to simplify your life and how becoming more self-reliant can save you money.

9 steps to simplify your life and save

Track your spending

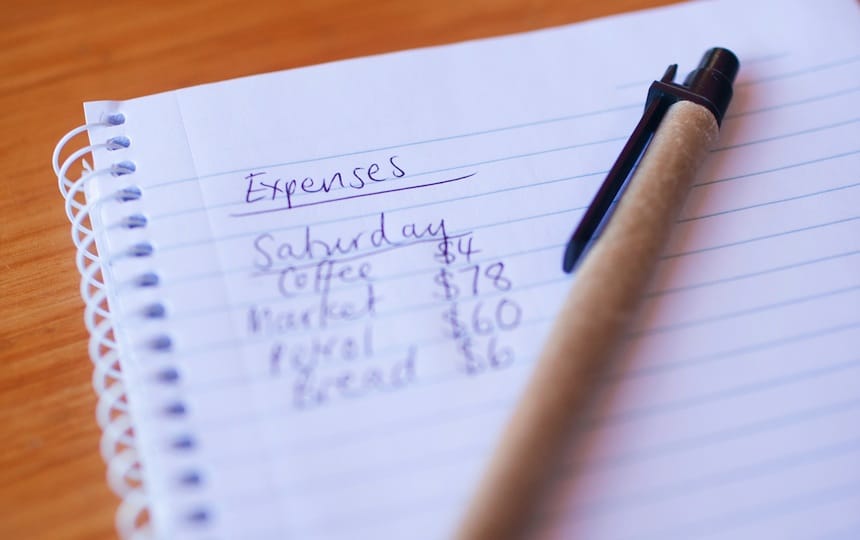

Track what you buy, both products and services, so you know exactly how much you’re spending and on what. This step is crucial. It’s the starting point and foundation of your financial rehabilitation.

Keep a small notebook and pen or use a phone app to record everything you spend.

Create a budget

Even if you hate the idea of doing this, it will help. A budget will give you a better understanding of what you need to pay out and how much is left over for saving, paying off debt or spending without the worry of over-spending.

Curb your non-essential spending

Always spend less than you earn. Not just this week but every week. Always take water with you when you go out. Join the library. Share and barter. Look in your wardrobe and see that you probably have enough.

Create an emergency fund

A good amount is around the $500–$1,000 mark but this will depend on the number of people in your family.

There will come a time when you get sick, need new tyres for the car or have to take the dog to the vet. Having that money in the bank will allow you to relax, knowing you will cope when you have to cover unexpected costs.

Pay off debt

This is a priority if you want to live simply. By focusing on your debt for 10 years instead of 25 years, you’ll give yourself options that you’d never have if you continue to work to pay a mortgage until you retire.

Audit your accounts

You need to be aware of what you’re spending on utilities, phone, internet services and insurances. Paying more than you have to wastes your money as well as the time you spend earning that money.

Put aside a couple of hours twice a year to go through your accounts and see what you can cut back on.

It’s sometimes possible to get a rate reduction or added services simply by contacting your supplier to ask for a better deal.

Always pay bills on time to avoid late fees, stop using ATMs with charges attached, check what bank fees you’re paying and if they’re excessive, look for a different account or another bank.

Rediscover housework

The work we do in our homes has been downgraded by advertising trying to sell us the latest appliances and the idea that a home is a commodity.

The work you do in your home can change you, and give your family a comfortable place that will nurture and support all who live there. You may need to learn a few new skills or discover traditional skills.

One thing is for sure, you’ll build a unique life that will be a mix of productivity, seasonal work, flexibility, outputs, harvests, creative cooking and opportunity. You’ll work out routines that make work easier and the level of self-reliance you’ll achieve will make you feel powerful.

Cook from scratch

Cook enough for two meals, then eat one meal and freeze the second. This is easy to do when making soup, curries, stews and sauces.

If you have a large freezer (an excellent investment), build up a stockpile of meals.

Make your own cleaning and laundry products

It’s easy to do; natural cleaners are effective and will save you a lot of money. It’s also a great way to cut down on the chemicals in your home, which is also much better for the environment.